Despite today’s more regulated and enlightened business environment, we continue to witness “Enron-esque” failures of corporate governance and compliance. Enron’s former CFO will make observations about how the ambiguity and complexity of laws and regulations breeds opportunity for problematic decisions and will discuss what questions corporate directors, management, attorneys, fraud examiners and auditors should ask, in order to ensure that their companies not only follow the rules, but uphold the principles behind them. Finally, he will discuss ways in which technology can be deployed to illuminate such problematic situations. Mr. Fastow was the Chief Financial Officer of Enron Corp. from 1998 – 2001. In 2004, he pled guilty to two counts of securities fraud, and was sentenced to six years in federal prison. He completed his sentence in 2011, and now lives with his family in Houston, Texas. Mr. Fastow currently consults with Directors, attorneys, and hedge funds on how best to identify potentially critical finance, accounting, compensation, and cultural issues. He is also a Principal of KeenCorp, an artificial intelligence software company. Mr. Fastow received a BA in Economics and Chinese from Tufts University and an MBA in Finance from the Kellogg Graduate School of Management at Northwestern University. Prior to joining Enron, he was a Senior Director in the Asset Securitization Group at Continental Bank N.A. Since his release from prison, Mr. Fastow has been a guest lecturer at universities and corporations, and at conferences for management, corporate directors, attorneys, accountants, and certified fraud examiners. Mr. Fastow was recently keynote speaker at the United Nations’ Principles of Responsible Management Conference, the FBI’s Advanced Financial Crimes Seminar, the Association of Certified Fraud Examiners Annual Conference, the American Accounting Association Annual Conference, and the Financial Times’ Outstanding Directors Conference.

Rules Versus Principles Ethics is understanding the difference between what is right to do and what you have the right to do. Fraud examiners, Auditors, Regulators, and Compliance experts look for “fraud”, but fraud is a narrowly defined term. Usually, these experts look for embezzlement, bribery, and the forging of incorrect financial entries. In other words, these experts look for employees who are “breaking the rules”. However, a majority of what is determined to be fraud “after-the-fact”, were actually decisions made by employees who believed they were “following the rules”. The “traditional” definition of fraud does not include a very significant component of fraud, namely “loopholes”. Loopholes, simply stated, are contrived structures that technically adhere to a rule (or at least obtain an opinion attesting to technical compliance), but that contravene the purpose, or principle, of the rule. Beginning in the 1980’s, there were two major systemic changes that gave rise to the “loophole” industry. The first was the advent of “structured finance”. The second was the explosion in the complexity of accounting, tax, and securities regulations. An industry comprising accountants, bankers, lawyers, and financial consultants arose to create financial structures that exploit this complexity, enabling companies to alter reported financials and to avoid taxes, all while “technically” complying with rules and regulations. Business executives now have at their disposal, an array of “legal” weapons that can fundamentally alter the appearance of their company’s financial condition. When is it acceptable to engage in a transaction that technically complies with the rules, but that may be misleading? Can a transaction that technically complies with the rules be considered unethical or illegal? Is it ever appropriate to depart from GAAP or IFRS? Mr. Fastow will cite examples of such transactions at major companies, he will discuss the rationalizations made by executives to justify their decisions, and he will discuss examples of how these decisions can cause great harm to stakeholders. He will make suggestions of questions that Regulators, Auditors, Fraud Examiners, and Directors might ask in order to ensure that their companies not only follow the rules, but also uphold the principles behind them. Finally, the former Chief Financial Officer of Enron Corp. will discuss his own story, and he will describe how he made such profound mistakes.

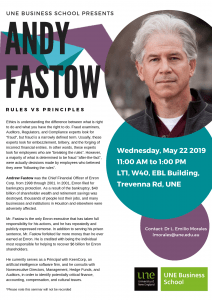

Andy Fastow will present his seminar on Wednesday 22nd of May 2019. The seminar will be held inside Lecture Theatre 1, EBL Buidling (W40) from 11.00am. Informal catering will be provided

Recent Comments