UNE Business School has been conducting surveys of food shoppers – the first round were carried out in August 2015 (before Aldi opening in Armidale) and the second in October 2016 (after Aldi opening). Interviews of shoppers took place in shopping malls, city streets and suburban streets in Armidale, and concerned retail shopping habits.

Professor Derek Baker offers a summary of the research below:

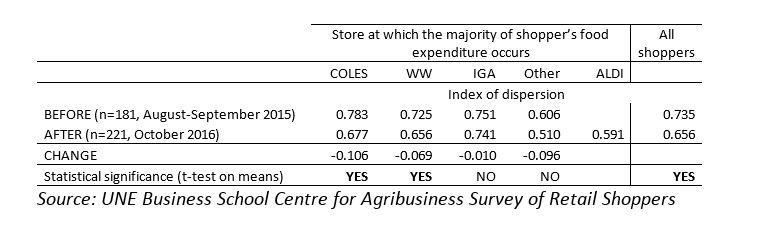

The table below presents a preliminary analysis of the extent to which Armidale shoppers share out their expenditures amongst the available stores.

The measure in the table below presents an index of dispersion: an index value of 1.00 represents a shopper that spends 100% of his or her food budget in one store, and 0.00 represents a shopper than spends 0% in any store. A shopper that spends 60% in one store and 10% in each of four other stores would have an index of 0.400.

Aldi shoppers (reported only in the AFTER row) appear to have a relatively low index of dispersion, meaning that Aldi shoppers also shop elsewhere to a large degree.

Across all retail food shoppers surveyed, the average index of dispersion fell from 0.735 to 0.656 between the two periods. This coincides with the period during which Aldi opened in Armidale, although we do not establish causality here. The largest reductions were seen amongst shoppers who reported spending the majority of their food budgets in Coles and Woolworths. Shoppers reporting spending the majority of their food budgets at IGA or in other stores also saw reductions in dispersion index, but these were not statistically significant.

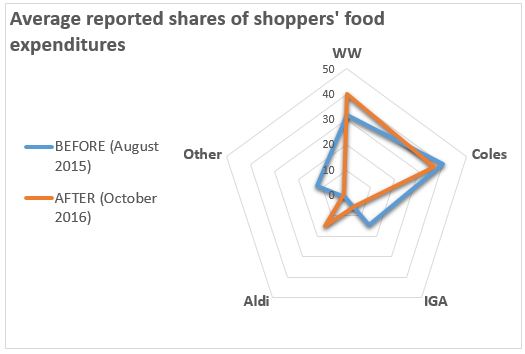

The diagram belong presents information on the average of Armidale food shoppers’ reported shares of food shopping expenditures on the two surveys. The numbers represent percentage of food expenditures spent in each store. It should be noted that this is not a measure of stores’ market shares, but rather a measure of food shoppers’ reporting shopping habits.

We observe a shift toward Aldi, at the expense of shares of expenditures in all stores except Woolworths, for which average reported shares of food expenditures increased. It is notable that the reported average share of expenditures in Aldi is low, at less than 20%.

Work on this survey, and further work on retail food, is continuing.

For more information, please contact Derek Baker at the UNE Business School’s Centre for Agribusiness (derek.baker@une.edu.au, tel. 02 6773 2627).